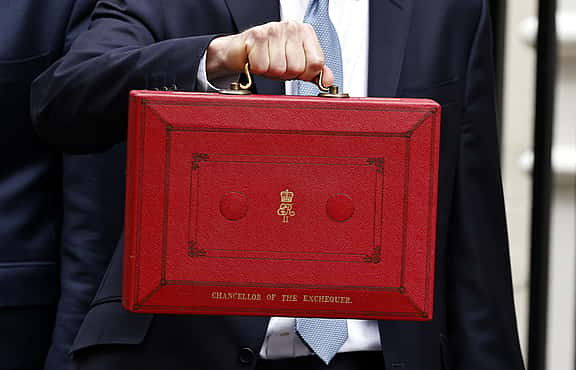

‘We are on track to become the next Silicon Valley’, said Jeremy Hunt in the Spring Budget as he dubbed 2024 the year of ‘Long Term Growth’.

These are big words. But as we’ve entered the year by tipping into recession once again – with the ONS highlighting that growth last year was estimated at 0.1%, the weakest since 2009’s financial crisis – should we really be paying them any heed?

The public’s verdict is, well, unsure. 27% of Britons thought the Budget was fair, whilst 32% say it wasn’t, according to YouGov. Over half (52%) said they didn’t think the changes would make much difference to the country as a whole.

But public apathy doesn’t mean that there aren’t takeaways from the Budget worth paying attention to. In fact, the speech revealed ripe opportunities for those with the initiative to take them.

Let’s explore the Chancellor’s Budget to highlight what new policies will impact businesses like yours, and how they can help you make your money work harder for you.

Welcoming the ‘year of SMEs’

One focus from the speech was on the relief and funding offered to the UK’s small and medium businesses.

For example, Hunt announced a £200 million extension of the Growth Guarantee Fund, a scheme providing a 70% guarantee to participating lenders on finance of up to £2 million offered to smaller businesses. It is expected to support 11,000 of these businesses to access the finance they need.

This kind of financing is recognized as a ‘vital ingredient in the smaller business finance landscape’ (Louis Taylor, CEO, British Business Bank) because it enables the flexibility required to thrive.

Armed with this funding, SMEs should explore the new tools available to help them grow. Equipment Leasing can help with this, allowing businesses to invest in the most up-to-date technology whilst balancing simple and easy monthly repayments.

Flexible funding like this is helping SMEs across all sectors, but the Budget highlighted a particular opportunity in sustainability.

The Green Industries Growth Accelerator, a fund established to support the expansion of renewable energy in the UK, will be allocated an extra £120 million to build supply chains for offshore wind and carbon capture and storage. This fund is available for businesses across the entire supply chain, from logistics to research and development.

There is debate about the effectiveness of the UK’s sustainability support. For example, KPMG noted that the funding unlocked in last year’s Autumn Budget paled in comparison to the $379 billion on offer in the US.

However, it’s clear that sustainability continues to be a focus for the UK government, and there seems to only be more money available for businesses ready to take it on. SMEs across the country should see Spring as time to explore what is out there, and how you can best set yourself up to take advantage of it.

Unlocking new investments

The Budget aims to usher in the future of business innovation. To be a part of this future, it’s clear you’ll need to get to grips with the suite of new tech out there, from AI to new machinery.

The good news is that doing so is becoming easier, with new draft legislation soon to be published that will extend full expensing, allowing a 100% deductible first year allowance on qualifying expenditure. This means that companies should receive up to a 25% in-year tax deduction for capital expenditure on key plant and machinery.

Crucially, the Chancellor announced that leased machinery will become part of the Full Expensing capital allowance regime, supporting smaller manufacturers to invest in new infrastructure with budgets they can manage.

And it’s not just about business investment. New tools mean you’ll need new skills to get the most out of them. It can feel overwhelming to have to constantly upskill yourself against an increasingly steep learning curve, but luckily there’s more good news.

The launch of a new £7.4 million upskilling fund pilot, designed to help SMEs cultivate AI skills and capitalise upon the opportunities presented by rapidly developing technology, will be incredibly useful.

So don’t be put off by the variety of choices for investment ahead. Take stock of what’s available and start ensuring you have the skills to use them now to shore yourself up for the future.

Exploring the manufacturing opportunity

Hunt highlighted that the government will continue to back ‘the industries of the future with millions of pounds of investment to make the UK a world leader in manufacturing’. It’s a lofty ambition, but it signals an exciting opportunity for a sector that now accounts for almost a tenth (9.3%) of the UK’s total economic output.

Backing this claim is a £360 million package to support innovative R&D and manufacturing projects across the life sciences, automotive and aerospace sectors. There is also a £50 million Apprenticeship Growth Sector pilot, which aims to support the development of 13 high-value apprenticeship standards across advanced manufacturing, green, and life sciences sectors.

What’s clear here is that it’s a good time to be in the manufacturing sector. This is a similar takeaway that we discovered in our recent report, ‘Lease for Life’, where we found that Leasing in the sector contributes a powerful £328 million overall Gross Valued Added (GVA).

With these new funding packages and the extension to full expensing, Leasing is only set to grow. That’s because businesses will increasingly need greater control of their budgets to ensure they can make the most of the opportunities for growth, which is likely why we found that over a third (36%) of respondents to our survey state that they expect to carry on using it to help their businesses grow.

So even though just 16% think Jeremy Hunt is doing a good job as Chancellor of the Exchequer, according to YouGov, the Budget has laid a positive path ahead.

The first step is to understand how these changes will affect you. Then, you can start planning your journey, whether you’re looking to understand the impact of a reduced National Insurance contribution, or planning a new investment phase to take advantage of new funding.

Ready to get started? Explore our website today, and read more about our research into the impact of Leasing on the UK below.